Home Office Expenses Rate 2023 . what’s covered by the rate. in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. you can claim a fixed rate of 67 cents for each hour you work from home. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. ato changes to home office expenses in 2023. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity.

from syccpa.com

The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. you can claim a fixed rate of 67 cents for each hour you work from home. in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. ato changes to home office expenses in 2023. what’s covered by the rate. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses.

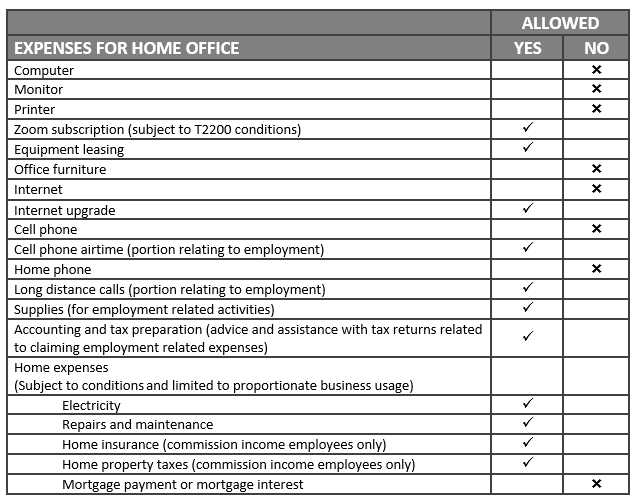

COVID19 Home Office Expenses What You Need to Know SCARROW YURMAN & CO

Home Office Expenses Rate 2023 you can claim a fixed rate of 67 cents for each hour you work from home. in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. ato changes to home office expenses in 2023. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. you can claim a fixed rate of 67 cents for each hour you work from home. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. what’s covered by the rate.

From dxoxxlwhe.blob.core.windows.net

Home Office Expenses Rate 2021 at Tyler Canter blog Home Office Expenses Rate 2023 what’s covered by the rate. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. ato changes to home office expenses in 2023. you can claim a fixed rate. Home Office Expenses Rate 2023.

From www.koroll.ca

Home Office Expense What You Need to Know to File Your Tax Return Home Office Expenses Rate 2023 in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. you can claim a fixed rate of 67 cents for each hour you work from home. what’s covered by the rate. On february 16 2023, the ato announced major changes. Home Office Expenses Rate 2023.

From boxas.com.au

Home Office Expenses The Essential Guide BOX Advisory Services Home Office Expenses Rate 2023 in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. ato changes to home office expenses in 2023. what’s covered by the rate. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home. Home Office Expenses Rate 2023.

From atotaxrates.info

Home Office Expenses Claim Rate 2024 Home Office Expenses Rate 2023 The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. ato changes to home office expenses in 2023. what’s covered by the rate. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. in its absence, the ato has now introduced an updated fixed. Home Office Expenses Rate 2023.

From societyone.com.au

Home Office & Work From Home Expenses SocietyOne Home Office Expenses Rate 2023 what’s covered by the rate. you can claim a fixed rate of 67 cents for each hour you work from home. in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. ato changes to home office expenses in 2023.. Home Office Expenses Rate 2023.

From templatebuffet.com

Home Office Expenses Excel Template Easily Track & Manage Your Costs Home Office Expenses Rate 2023 you can claim a fixed rate of 67 cents for each hour you work from home. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. what’s covered by the rate. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. in its absence,. Home Office Expenses Rate 2023.

From www.prosaic.works

Home Office Expenses Calculator Spreadsheet GST & Tax Deductions Home Office Expenses Rate 2023 ato changes to home office expenses in 2023. what’s covered by the rate. you can claim a fixed rate of 67 cents for each hour you work from home. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. in its absence, the ato has now introduced. Home Office Expenses Rate 2023.

From syccpa.com

COVID19 Home Office Expenses What You Need to Know SCARROW YURMAN & CO Home Office Expenses Rate 2023 what’s covered by the rate. in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. you can claim a fixed rate of 67 cents for each hour you work from home. The revised fixed rate of 67 cents per work. Home Office Expenses Rate 2023.

From www.zippia.com

20+ Average Monthly Expense Statistics [2023] Average Household Home Office Expenses Rate 2023 ato changes to home office expenses in 2023. you can claim a fixed rate of 67 cents for each hour you work from home. what’s covered by the rate. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. the ato has released new guidelines contained in practical compliance guide 2023/1 for. Home Office Expenses Rate 2023.

From thewealthywill.wordpress.com

“Cutting Costs Tips for Managing Home Office Expenses During the Home Office Expenses Rate 2023 you can claim a fixed rate of 67 cents for each hour you work from home. what’s covered by the rate. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. On february 16 2023,. Home Office Expenses Rate 2023.

From www.youtube.com

2023 Budget With Me Expenses + Savings Simple And Realistic Excel Home Office Expenses Rate 2023 what’s covered by the rate. you can claim a fixed rate of 67 cents for each hour you work from home. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. in its absence,. Home Office Expenses Rate 2023.

From assentt.com

Home Office Expenses Form ASSENTT Home Office Expenses Rate 2023 you can claim a fixed rate of 67 cents for each hour you work from home. ato changes to home office expenses in 2023. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. . Home Office Expenses Rate 2023.

From thebasispoint.com

What's the best home equity strategy for homeowners and lenders given Home Office Expenses Rate 2023 you can claim a fixed rate of 67 cents for each hour you work from home. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. in its absence, the ato has now introduced an. Home Office Expenses Rate 2023.

From www.pinterest.com

Home Office Expense Costs that Reduce Your Taxes Home office expenses Home Office Expenses Rate 2023 in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. you can claim a fixed rate of 67 cents for each hour. Home Office Expenses Rate 2023.

From dxojfhasg.blob.core.windows.net

How Much Can I Expense For Home Office at Stella Heller blog Home Office Expenses Rate 2023 the ato has released new guidelines contained in practical compliance guide 2023/1 for taxpayers claiming home office expenses. you can claim a fixed rate of 67 cents for each hour you work from home. ato changes to home office expenses in 2023. what’s covered by the rate. The revised fixed rate of 67 cents per work. Home Office Expenses Rate 2023.

From soundcloud.com

Stream episode January 26, 2023 Home Office Expenses by The Mad Home Office Expenses Rate 2023 On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. what’s covered by the rate. ato changes to home office expenses in 2023. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. the ato has released new guidelines contained in practical compliance guide. Home Office Expenses Rate 2023.

From fabalabse.com

What home expenses are tax deductible 2023? Leia aqui What is the Home Office Expenses Rate 2023 what’s covered by the rate. The revised fixed rate of 67 cents per work hour covers energy expenses (electricity. ato changes to home office expenses in 2023. On february 16 2023, the ato announced major changes to how you can claim home office expenses in your. in its absence, the ato has now introduced an updated fixed. Home Office Expenses Rate 2023.

From soundcloud.com

Listen to playlists featuring February 2, 2023 Employee Home Office Home Office Expenses Rate 2023 ato changes to home office expenses in 2023. what’s covered by the rate. in its absence, the ato has now introduced an updated fixed rate method which has gone up from 52 cents to 67 cents, kicking off from march. On february 16 2023, the ato announced major changes to how you can claim home office expenses. Home Office Expenses Rate 2023.